Donations play a pivotal role in supporting various charitable causes and contributing to the societal development. Section 80G of the Indian Income Tax Act provides tax deductions for donations made to eligible organizations. Understanding the nuances of Section 80G is essential for both donors and recipients, ensuring accountability in charitable

Claim Tax Benefits with 80G Donations

Securing tax benefits while contributing to worthy causes is a win-win situation. Under India's Income Tax Act, donations made to registered charitable organizations under Section 80G can potentially minimize your tax liability. These generous contributions offer significant financial incentives for individuals who wish to support social welfare. B

Considerations To Know About asset talent test

They’re usually established in the vacuum, are not aligned with the corporation’s aims and values, and therefore are not performed in session with leaders and employing supervisors. Online talent assessments help candidates get an notion of your respective tradition and values. It’s also a lot easier for them to hit the ground running due to

The Single Best Strategy To Use For donating for tax purposes

A pay back stub, Form W-two, or other document furnished by your employer that reveals the amount withheld to be a contribution; and Enter on line 11 of the worksheet, fifteen% of your respective Internet income for the year from all sole proprietorships, S firms, or partnerships (or other entity that isn't a C corporation) from which contribution

donate tax benefit No Further a Mystery

generating charitable donations not simply means that you can assist triggers you treatment about but will also offers opportunity tax benefits. knowing how tax deductions function is important to maximizing your savings. it is possible to assert possibly genuine expenses or a mileage allowance of 14 cents for every mile. The latter is much much e

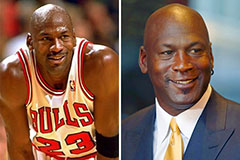

Michael Jordan Then & Now!

Michael Jordan Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!